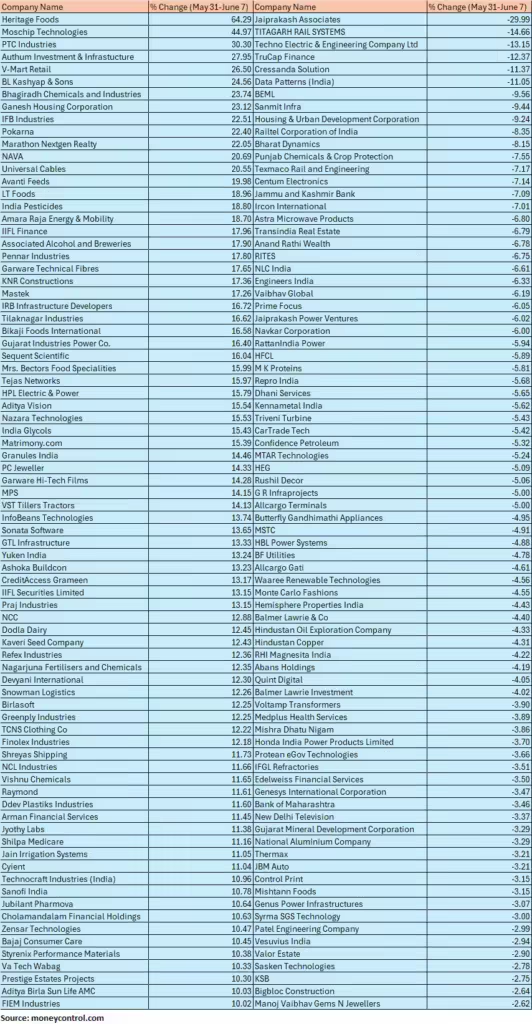

80 smallcaps gain between 10-64% as market hits fresh high

The broader market indices exhibited robust gains in the volatile week ending June 7, aligning closely with the performance of the main indices, which were influenced by varying general election results compared to exit polls

Positive factors such as the Reserve Bank of India’s upward revision of GDP forecast, declining crude oil prices, increased GSP collection, the European Central Bank’s rate cut, and the progression of monsoon rainfall collectively bolstered investor confidence.

On the other hand, Jaiprakash Associates, Titagarh Rail Systems, Techno Electric & Engineering Company, TruCap Finance, Cressanda Solution, Data Patterns (India) fell 11-30 percent.

Where is Nifty50 headed?

Rupak De, Senior Technical Analyst, LKP Securities

The short-term trend looks very positive as the index closed near an all-time high. Going forward, the market remains a buy on dips as long as 23000 is not broken. On the higher end, the index might move towards 23500-23600. On the lower end, profit booking might occur only below 23000.”

Nagaraj Shetti, Senior Technical Research Analyst at HDFC Securities

The short-term trend of Nifty continues to be positive. Having reached the overhead resistance of around 23300-23400 levels, there is a possibility of minor dip in the market from the highs in the short term and that could be a buying opportunity. Immediate support is at 22900 levels.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

On the daily charts we can observe that the Nifty has been inching higher after a sharp decline on Tuesday earlier during this week. It has recovered all the lost ground and is within touching distance of previous all-time high of 23338. The V shape recovery has put the structure in the Favor of bulls and dips towards support zone 22800 – 22700 should be used as a buying opportunity. On the upside the psychological level of 23500 is likely to attract some profit booking at higher levels.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.